China and the U.S. are battling to dominate the key technologies of today and tomorrow. For a long time there was more cooperation than competition in various high-technology realms. Even then, however, the U.S. complained about intellectual property theft and economic espionage. U.S. firms often shared older technology with Chinese joint venture partners. The U.S. government occasionally intervened to prevent the transfer of key technologies. In 1990, for example, the George H.W. Bush administration cancelled the sale of American aviation parts company to a Chinese state firm.

Such interventions remain rare, but they’ve increased since 2016. Presidents Barack Obama and Donald Trump blocked three deals for U.S. semiconductor companies. Some other semiconductor company deals were dropped because the parties worried they would not survive scrutiny by the Committee on Foreign Investment in the U.S. (CFIUS). CFIUS has permitted Taiwanese and other foreign companies to purchase U.S. semiconductor firms. The CFIUS website now has a link for people to submit “tips, referrals, or other issues related to national security risks and foreign investment in the United States.” Since 2018, the U.S. Bureau of Industry and Security has had expanded authority to regulate foreign access to U.S. emerging and foundational technologies.

China's party-state has long prioritized investing in technologies it considers critical. Economic plans mapped much of this out, perhaps most famously in Made in China 2025 (MIC2025), an outline released in 2015. Click here to see an English-language infographic prepared at the time to illustrate production, market share and capability targets for the auto industry. The government's Chinese language website for the effort hasn't been recently updated. A Paulson Institute study found that after U.S. newspapers began reporting on MIC2025, Chinese media references to it fell off dramatically.

China has generally been quite open to foreign investment, but it has always limited foreign investment or acquisitions in sensitive sectors (e.g., media, telecommunications and courier services). Tesla was the first foreign automaker to be able to enter the market without a Chinese partner. To utilize Chinese talent and, sometimes, at the behest of Chinese partners or government entities, many foreign firms have established research and development operations in China. Because of intellectual property concerns, however, most American firms restrict the work done in their China research and development centers. China’s government has repeatedly cautioned its citizens to be on guard against foreign espionage efforts (e.g., 2023, 2021, 2016).

Under Pres. Joe Biden, the U.S. has stepped up restrictions on tech sector trade and investment. Some analysts have judged these efforts as ineffective and some worry they hamper the American firms in industries the U.S. hopes to protect.

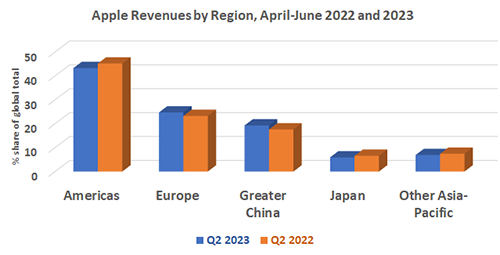

In August, Apple reported that its revenues in China had grown 8%, but in September there were reports that government staffers in central ministries were told to not use iPhones at work. The U.S. has also restricted the use of Huawei phones and the TikTok app by military and government employees. The chart below shows the regional shares of Apple's global revenues. "Greater China" produced 17.6% of Apple's April-June 2022 revenues and this share grew to 19.1% in 2023.

Huawei has been a particular target for U.S. restrictions. Those restrictions initially worked. Huawei’s cell phone business cratered and the company spun off the Honor brand. But Huawei has recovered, releasing its latest Mate phones – while U.S. Commerce Secretary Gina M. Raimondo visited China. The smartphones utilize China’s most advanced mobile processor. The company, already a global leader in 5G networking technology, continues to compete globally. In April, Brazil’s Pres. Luiz Inacio Lula da Silva led a delegation to China that included a stop at Huawei.

Brailian delegation visits Huawei (Huawei photo).

China's government has also shown that it can play the sanctions game as well. Exports of processed rare earth minerals have been constrained or regulatory hurdles have been added. These include gallium and germanium, used in semiconductor production. Last week, China's government began mandating companies get export permits for graphite products. Graphite is a key part of rechargeable batteries. Since China produces 90% of the world's refined graphite, this could impede efforts to develop battery production in the U.S. and elsewhere.

Supply chain resilience, economic autonomy and national security worries have caused American and Chinese leaders to invest huge sums in developing technologies and building tech-infrastructure. The centrality of Taiwan in the production of the most advanced chips has only heightened regional security concerns. The U.S. and China remain joined at the hip economically. Producers, customers and shareholders have benefited, but geopolitical tensions and government regulations are starting to change companies’ trade and investment decisions.

Resources

Scholar Douglas Fuller examined the pivotal role of hybrid firms in driving technological development (lecture | interview).

Audrey Tang is Taiwan's digital minister. She spoke with US-China Today on the evolving role of technology from personal computing to a powerful force for social change and collaborative governance in the digital age.

Long ago, USC finance professor Baizhu Chen used iPhone manufacturing to explain how the U.S. benefits from outsourcing to China.

USCI looked at Apple and China in 2020.

The Asia Society, Rhodium Group and USCI looked at China's high-tech investing in 2014.

The tech rivalry led the Trump administration to increase efforts to stem illicit technology theft. That program, the China Initiative yielded decidedly mixed results, including intense and unwarranted scrutiny of Chinese American researchers. Here is Attorney General William Barr's assessent of the threat posed and the Department of Justice's response. USCI has several additional interviews and presentations on the initiative.

The U.S. Defense Department has analyzed China's technology transfer strategy.

Click here to subscribe to the USCI newsletter. It includes information about upcoming events, professional development opportunities, and quick looks at important issues in U.S.-China relations and trends in contemporary China. Previous issues are available here.