Subscribe to our weekly newsletter to get them delivered straight to your inbox!

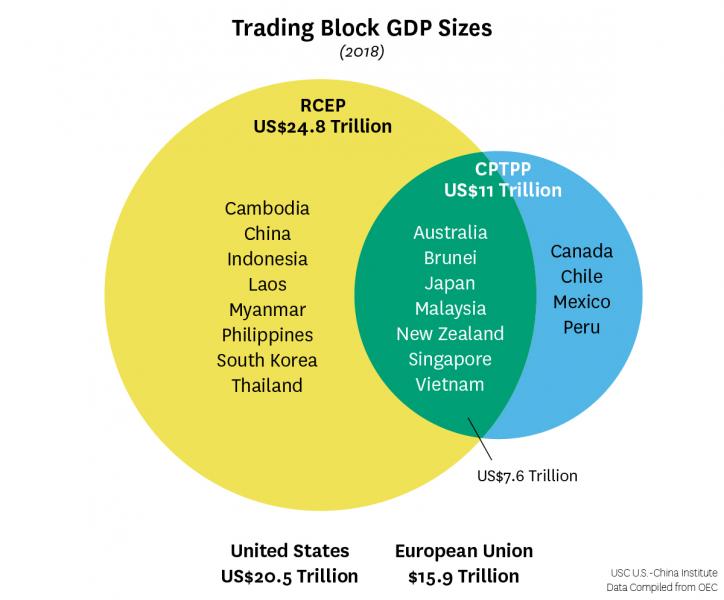

Had the U.S. stayed in the TPP, it would have been the largest trade network in history, lowering tariffs and requiring labor and environmental protections. The new free-trade area would have reduced members’ reliance on trade with China and let the U.S. lead in the region. Instead, with the Chinese backed RCEP, the balance of power in the Asia-Pacific is shifting to Beijing. When signed, the RCEP will be the world’s largest trading bloc, overtaking the United States–Mexico–Canada Agreement (USMCA) and European Single Market. Critics worry that, now unchecked by the U.S., China will be able to set the rules and standards for global trade through its influence.

While President Trump withdrew the U.S. from the TPP to focus on trade deals with individual countries, the U.S. still has enormous power in global trade because of its size. It trades more with CPTPP countries than RCEP ones, as Mexico and Canada are two of its top three trading partners, respectively, and the USMCA is still the largest trading agreement by GDP.

CPTPP countries clearly buy much more from the US than do RCEP ones. The seven countries in both trade agreements account for US$292 billion in imports and US$150 billion in exports to the U.S.