Yen addresses the mistakes Westerners sometimes make while trying to overcome cultural barriers in doing business with Chinese. He argues that understanding traditional Chinese culture, and how it affects management behaviors and current events, can help decision makers make better decisions in business, finance and politics. He further combines culture with credit analysis to argue that it is unlikely that China will suffer a financial collapse despite a slowing economy and high debt levels. Yen shows how some of these traditions also hamper China’s efforts to innovate or project the “soft power.” He’ll discuss efforts to integrate China more fully into the global community and will suggest ways policy makers can forge more realistic policies. Yen firmly believes none of this can be accomplished without deeper cultural and historical knowledge on both sides.

This video is also available on the USCI YouTube Channel.

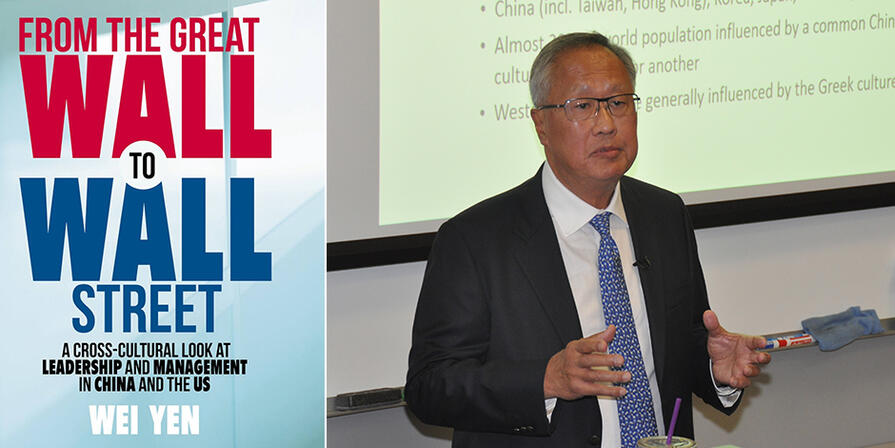

Yen is the author of From the Great Wall to Wall Street: A Cross-Cultural Look at Leadership and Management in China and the U.S., published by Palgrave Macmillan earlier this year. He retired from CITIC Pacific in Hong Kong, where he was the Group Treasurer. Before CITIC, Wei was a managing director in corporate finance for Lehman and Nomura and the managing director for Moody’s Asia FIG rating practices. He also had experience as CFO for iSwitch, a tech company in Shenzhen. Yen began his financial career in New York in biotech venture capital with Rothschild.