Join us for a free one-day workshop for educators at the Japanese American National Museum, hosted by the USC U.S.-China Institute and the National Consortium for Teaching about Asia. This workshop will include a guided tour of the beloved exhibition Common Ground: The Heart of Community, slated to close permanently in January 2025. Following the tour, learn strategies for engaging students in the primary source artifacts, images, and documents found in JANM’s vast collection and discover classroom-ready resources to support teaching and learning about the Japanese American experience.

Congressional Research Service, “China and the Global Financial Crisis: Implications for the United States,” June 3, 2009

View reports from other months:

June | April | February

Summary

Over the past several years, China has enjoyed one of the world’s fastest growing economies and has been a major contributor to world economic growth. However, the current global financial crisis threatens to significantly slow China’s economy. Several Chinese industries, particularly the export sector, have been hit hard by crisis, and millions of workers have reportedly been laid off. This situation is of great concern to the Chinese government, which views rapid economic growth as critical to maintaining social stability. China is a major economic power and holds huge amounts of foreign exchange reserves, and thus its policies could have a major impact on the global economy. For example, the Chinese government in November 2008 announced plans to implement a $586 billion package to help stimulate the domestic economy. If successful, this plan could also boost Chinese demand for imports. In addition, in an effort to help stabilize the U.S. economy, China might boost its holdings of U.S. Treasury securities, which would help fund the Federal Government’s borrowing needs to purchase troubled U.S. assets and to finance economic stimulus packages. However, some U.S. policymakers have expressed concerns over the potential political and economic implications of China’s large and growing holdings of U.S. Government debt securities. This report will be updated as events warrant.

Click here for a listing of reports released by the Congressional Research Service.

Featured Articles

Please join us for the Grad Mixer! Hosted by USC Annenberg Office of International Affairs, Enjoy food, drink and conversation with fellow students across USC Annenberg. Graduate students from any field are welcome to join, so it is a great opportunity to meet fellow students with IR/foreign policy-related research topics and interests.

RSVP link: https://forms.gle/1zer188RE9dCS6Ho6

Events

Hosted by USC Annenberg Office of International Affairs, enjoy food, drink and conversation with fellow international students.

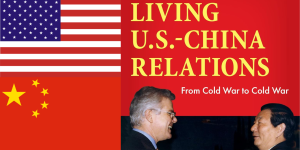

Join us for an in-person conversation on Thursday, November 7th at 4pm with author David M. Lampton as he discusses his new book, Living U.S.-China Relations: From Cold War to Cold War. The book examines the history of U.S.-China relations across eight U.S. presidential administrations.